Corporate Petty Cash Management Application

Petty Cash Expense Management is designed to facilitate employees in conducting petty cash payment transactions and to assist companies in managing and controlling petty cash usage, including defining authorized users, periods, locations, purposes, categories, and transaction amounts, as well as enabling paperless collection of transaction evidence. Consequently, the company’s finance department can monitor, evaluate, approve, and record expenditures more efficiently.

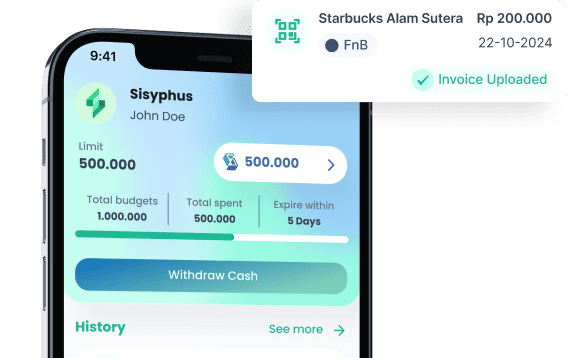

Transaction Application

The Android and iOS-based Petty Cash Mobile Application is used by employees for transactions related to petty cash usage. This application ensures employees adhere to petty cash usage procedures, for example, regarding categories, timeframes, transaction limits, and specific locations.

Paperless Reporting

Employees can directly submit photos of transaction evidence and specify the allowed transaction categories. This data will be validated by the company’s finance department.

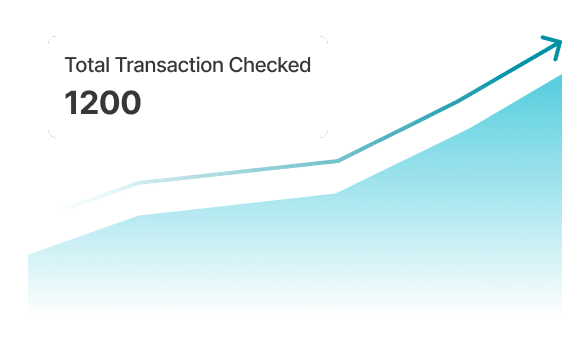

Increased Accuracy

This system reduces human error in recording and reporting financial transactions. Consequently, the generated data is more accurate and reliable for decision-making.

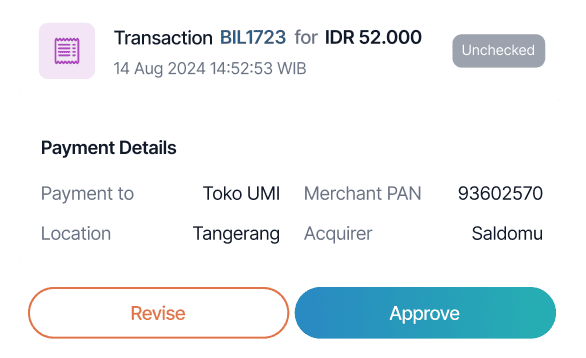

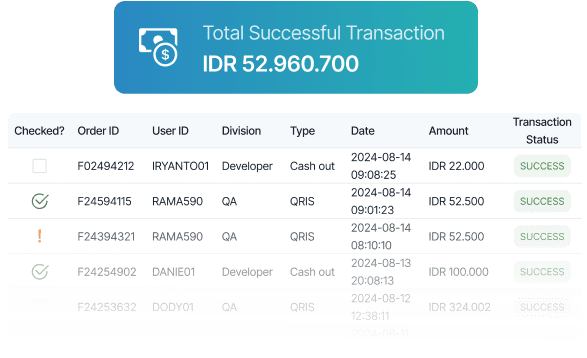

Workflow

The finance department can obtain real-time transaction data and easily perform validation. If there are any discrepancies, feedback can be immediately provided to the employee for correction. Once approved, reports can be exported to the financial system and are easily reconcilable as they are equipped with recording codes.

Report Time Savings

By automating the recording and reporting process, equipped with transaction and account codes, this system saves time for administrative and accounting staff by eliminating the need for time-consuming and error-prone manual recording. Transaction data can be downloaded and exported to your financial system.

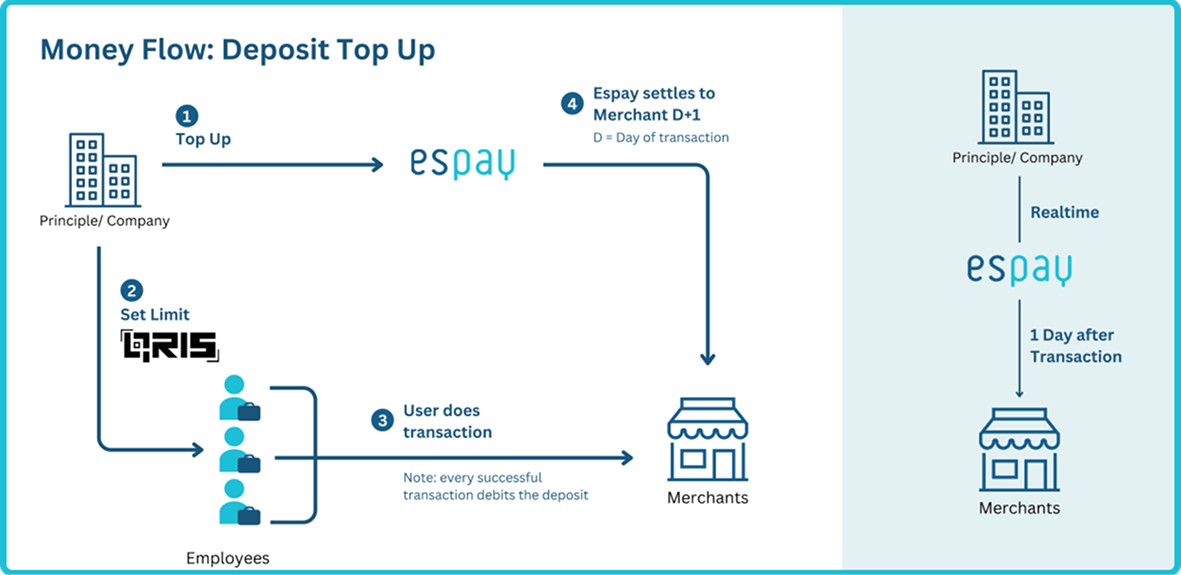

Cashless and Efficient

Employees do not need to cover expenses upfront, nor does the company need to provide funds in advance. This eliminates the need for collecting paper transaction evidence and reimbursement forms, as well as the tedious task of processing reimbursement payments.

Workflow

The Finance Department obtains transaction data based on

5W 1H

Who? (Who)

The party conducting the transaction

Where? (Where)

Location or place of the transaction

When? (When)

Time or date the transaction occurred

What? (What)

Method and category of the transaction

Why? (Why)

Reason for the transaction, such as related to a specific customer or project.

How much? (How much)

Nominal value of the transaction

With this data, the Finance Department can record and monitor transactions in a more structured and accurate manner.

Petty Cash Mobile Application