Corporate Petty Cash Management Application

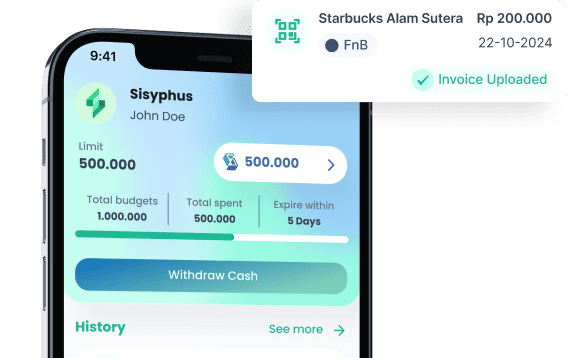

Petty Cash Expense Management is designed to facilitate employees’ petty cash transactions while helping companies manage and control their usage. This includes defining authorized users, periods, locations, purposes, categories, and transaction amounts, as well as collecting transaction evidence paperlessly. As a result, the company’s finance team can monitor, evaluate, approve, and record expenses more efficiently.

Application for Transactions

The Android and iOS-based Petty Cash Mobile App is designed for employees to carry out petty cash transactions while ensuring compliance with company procedures. It supports usage based on categories, time periods, transaction limits, and specific locations.

Paperless Reporting

Employees can instantly upload photos of transaction receipts and select the permitted transaction categories. The company’s finance team then validates the data.

Improved Accuracy

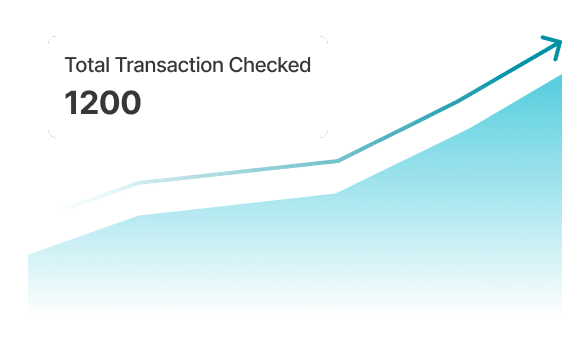

This system minimizes human errors in recording and reporting financial transactions, resulting in more accurate and reliable data for decision-making.

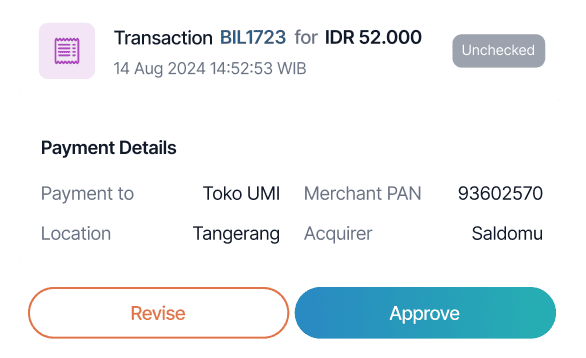

Workflow

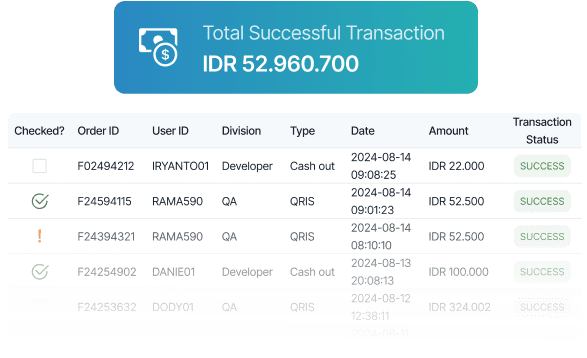

The finance team can access transaction data in real time and validate entries easily. If discrepancies are found, feedback can be provided directly to employees for correction. Once validated, reports can be exported into the company’s financial system and reconciled seamlessly using predefined accounting codes.

Time-Saving Reporting

By automating transaction recording and reporting with transaction and account codes, the system reduces the administrative and accounting team’s workload, eliminating manual processes that are time-consuming and error-prone. Transaction data can be downloaded and exported into your financial system.

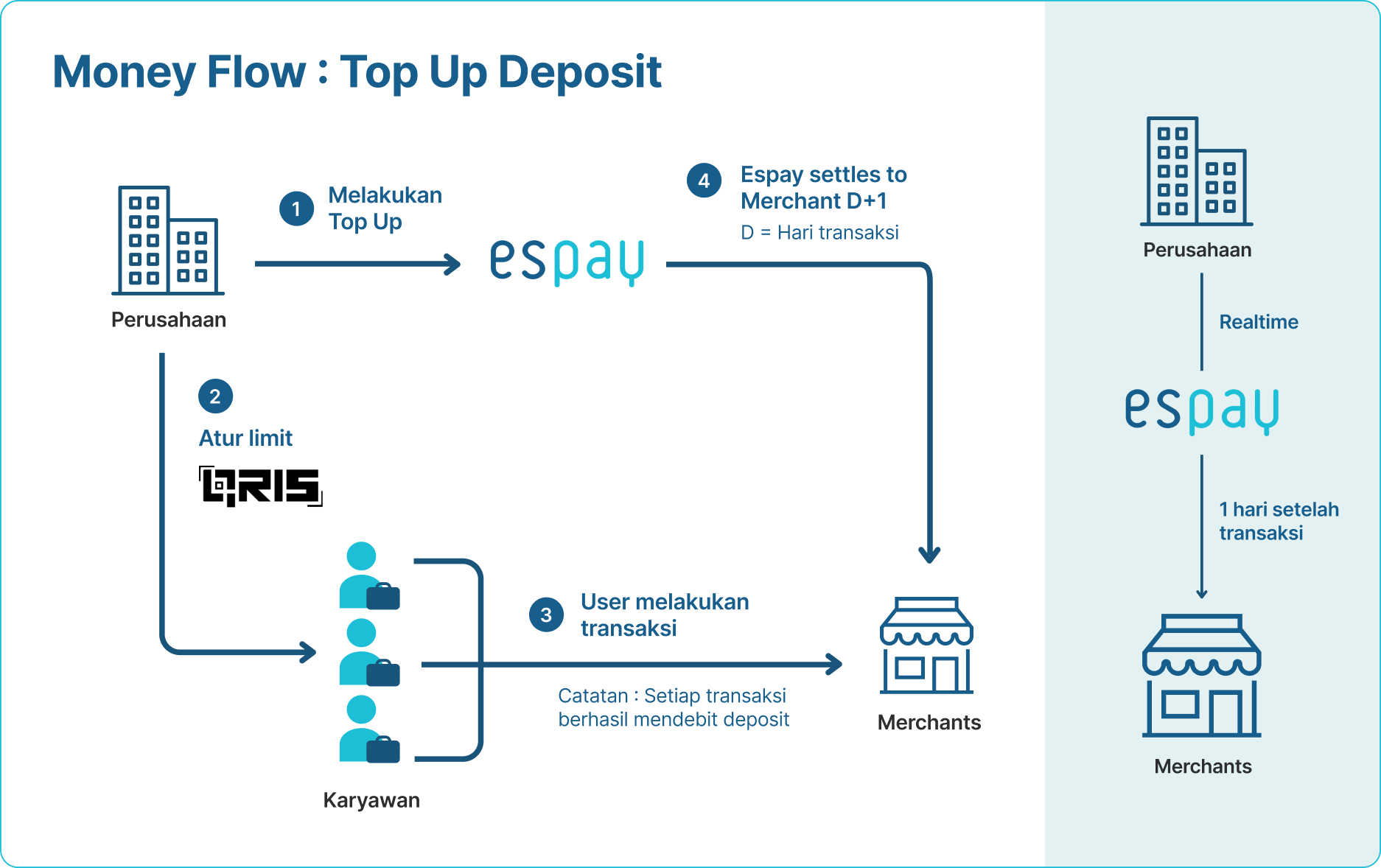

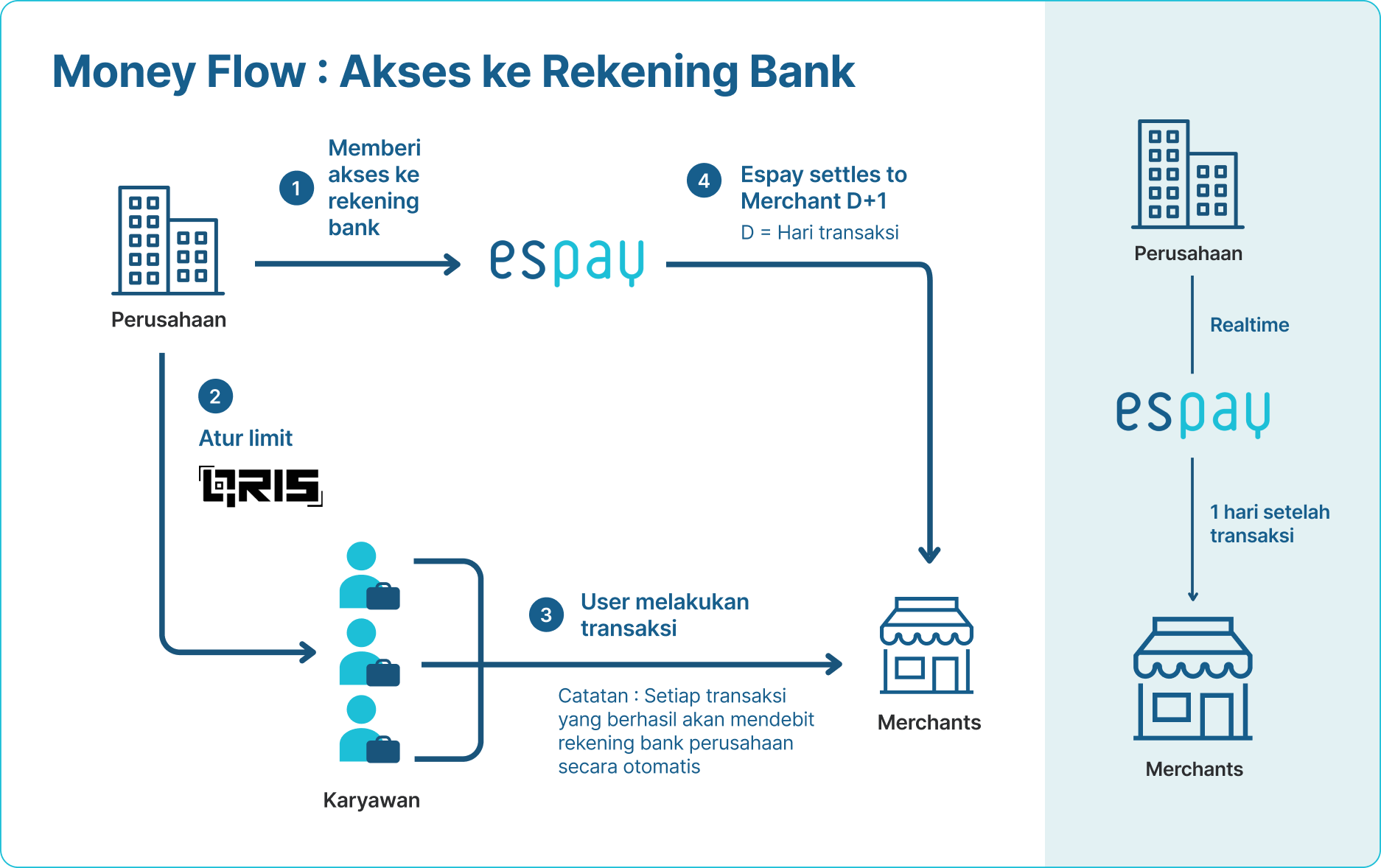

Cashless and Efficient

Employees no longer need to cover expenses upfront, and companies don’t need to distribute cash in advance. There’s no need to collect paper receipts or reimbursement forms, reducing the burden of manual reimbursement processes.

Workflow

The Finance Department obtains transaction data based on the

5W 1H

framework:

Who?

The person who performed the transaction

Where?

The location or place where the transaction occurred

When?

The time or date the transaction was made

What?

The method and category of the transaction

Why?

The reason for the transaction, such as being related to a specific customer or project

How much?

The nominal value of the transaction

With this data, the Finance Department can record and monitor transactions in a more structured and accurate manner.

Petty Cash Mobile Application