![bwink_bld_04_single_08 [Converted]-01 Elektronifikasi Pemerintah Daerah](https://espay.id/wp-content/uploads/2023/01/bwink_bld_04_single_08-Converted-01-1.png)

Local Government Electronification

In accordance with the Program for Implementation of Non-Cash Transactions at Regency/City Governments which was confirmed by the issuance of Government Regulation No.12/2019 Article 222 which contains the obligation of Regional Governments to implement an electronic-based government system in the field of regional financial management. Presidential Decree 3/2021 concerning the Task Force for the Acceleration and Expansion of Regional Digitalization in the context of increasing the Local Government Transaction Index (ITPD), Espay provides end-to-end solutions for Regional Governments at both the provincial and district/city levels.

The solution is divided into two but connected parts, namely:

-

Regional Revenue Electronification Solutions through the e-Penda system.

-

Regional Financial Management Solutions (Cash Management) through the Integrated Fund Management and Disbursement System (SP2DT).

Legal basis

![bwink_msc_08_single_04 [Converted]-01](https://espay.id/wp-content/uploads/2023/01/bwink_msc_08_single_04-Converted-01.png)

Presidential Instruction No.10/2016

one of which contains directions for accelerating the implementation of non-cash transactions in all Ministries/Institutions and Regional Governments

Minister of Home Affairs Circular Letter No.910/1866/SJ

concerning the Implementation of Non-Cash Transactions at Provincial Governments

Minister of Home Affairs Circular Letter No.910/1867/SJ

concerning the Implementation of Non-Cash Transactions at District/City Governments

Government Regulation No.12/2019 Article 222

which contains the regional government’s obligation to implement an electronic-based government system in the field of regional financial management

Minister of Home Affairs Circular Letter No.910/1866/SJ

concerning the Implementation of Non-Cash Transactions at Provincial Governments

Presidential Decree No. 3 Year 2021

Bank Indonesia (BI) supports the Government’s efforts to accelerate and expand regional digitalization. This is realized by BI’s membership in the Task Force for the Acceleration and Expansion of Regional Digitalization (Satgas P2DD).

Minister of Home Affairs Circular Letter No.910/1867/SJ

concerning the Implementation of Non-Cash Transactions at Regency/City Governments which was confirmed by the issuance of Government Regulation No.12/2019 Article 222 which contains the obligations of Regional Governments to implement an electronic-based government system in the field of regional financial management

This is in accordance with Bank Indonesia’s directives for the acceleration of 3 priority sectors, namely:

- Local government electronification

- Electronification of social assistance

- Electronification in the field of transportation

This is also in accordance with the recommendations of the BPK and KPK for each local government to implement electronic-based regional financial governance.

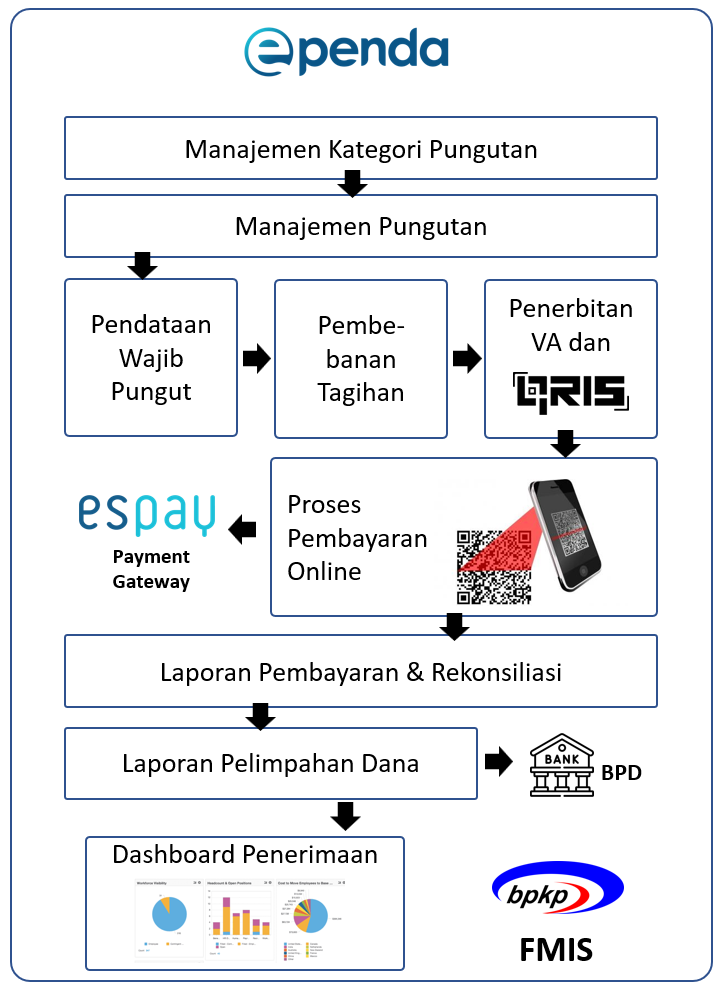

e-Penda is an end-to-end electronic-based local revenue management system. E-Penda provides electronic solutions that are fast and effective, starting from simple processes so that local governments can easily use them and those that are more complex.

The modules currently available are:

- Collection Category Management, to classify the types of fees that exist, for example: Market Fees, Tourist Attractions Fees, Parking Fees and others.

- Collection Management

- Compulsory collection of data

- Charging of Bills both recurring and at any time

- Printing QRIS Bills or Virtual Accounts, QRIS can be printed directly because e-Penda is online connected to QRIS issuers via a Payment Gateway.

- Payment Transaction Reports can be viewed in real time.

- Reconciliation of Transactions against Compulsory Collectors.

- Funds Transfer Report

- Acceptance Dashboard

The e-Penda system can be used to manage market fees, official housing fees, tourist site fees, transportation fees, garbage fees, advertisement fees, and other fees.

Reports can be integrated with the FMIS system from BPKP.

Collaboration with Regional Development Banks

![Frame [Recovered]-02 Integrasi Espay](https://espay.id/wp-content/uploads/2019/11/integrasi-compressor.png)

Espay Payment Gateway as a Non-Bank Payment Service Provider Licensed by Bank Indonesia is a strategic partner of the Regional Development Bank. Espay’s role includes providing a payment administration system and providing QRIS payment channels issued by the local Bank. In terms of transferring funds, Espay aggregates receipts from various payment channels and transfers funds to the regional treasury account (RKUD) at the local Regional Development Bank.

In the framework of the Integrated Fund Management and Disbursement System (SP2DT) solution where Espay provides Cash Management features for local governments, Espay also collaborates with local Regional Development Banks so that local government transactions can be carried out online-realtime.

Provincial Government Integrated Tax & Retribution Payment System

Provincial Government Integrated Tax & Retribution Payment System

Kiosks & Mobile Applications for Payment of Motor Vehicle Tax use QRIS & Virtual Accounts which include interconnection with the Motor Vehicle Tax core system, billing codes, QRIS or VA issuance, payment, reconciliation, tax printing.

Regional Revenue Administration System for Payment of Water Tax

Surface Integrated which includes the official assessment of surface water use, data collection on mandatory collection, calculation and determination, SPOPD, issuance of SKPD, STPD, payment, reconciliation, reporting

Integrated Motorized Vehicle Fuel Tax

which includes official assessment, collection of compulsory collection data, issuance of SPTPD, determination of SPTPD, validation, SKPDKB, SKPDKBT, SKPDN, SSPD of payment transactions, reconciliation, reporting

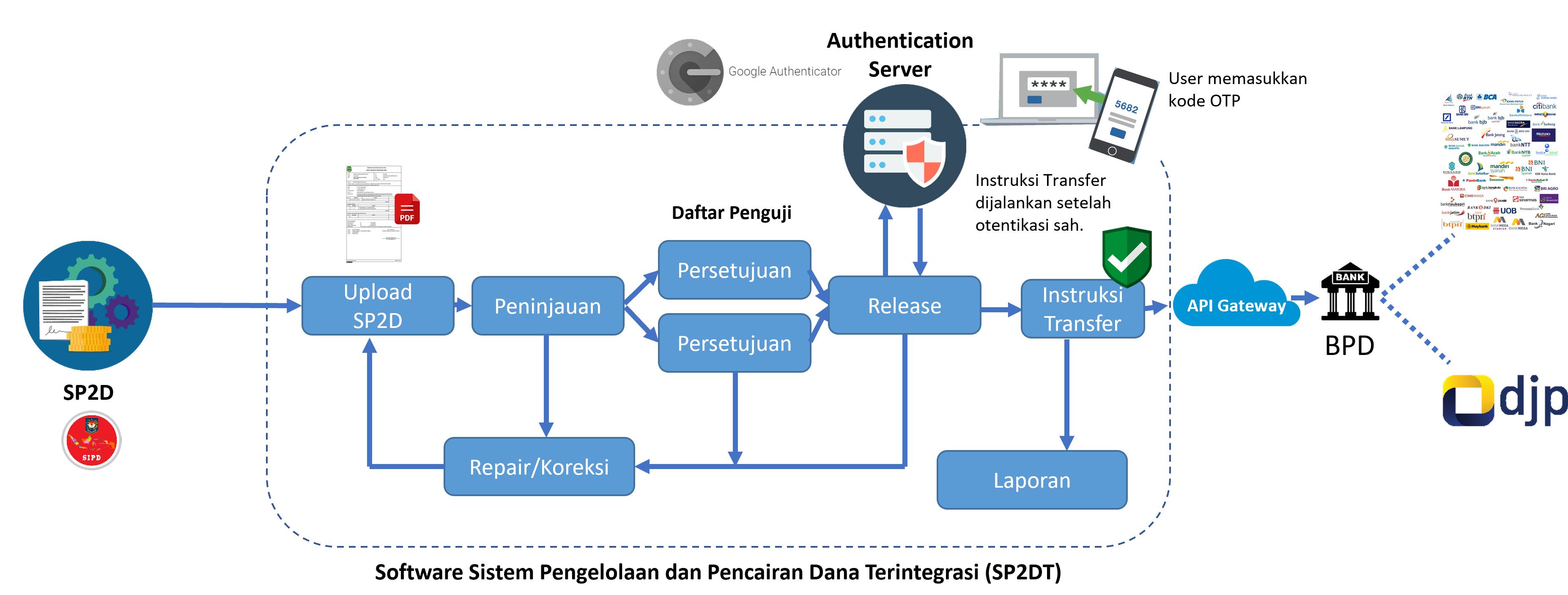

Integrated Fund Management and Disbursement System (SP2DT) – Cash Management

Basic Cash Management platform with features:

-

Cash Management Portal (user module) with the function of information on bank balances, Transaction workflows, Open Banking API instructions for multiple banks, both BPD and other Himbara banks.

-

Open Banking API integration via Payment Gateway

-

Backoffice (to make settings and configurations)

-

Import/transfer SP2D disbursement data into Cash Management

-

Staged verification and control

-

Transaction approval authorization uses 2FA, namely One Time Password (OTP)

-

Transaction Reports

-

Audit Trails

-

Integration with budgeting systems and contract documents so that disbursement of payments can be controlled not to exceed the ceiling

-

Regional treasury account monitoring system (RKUD)

-

Payment discount module

-

Integration with MPN Gen 3 for payment of related taxes

-

Integration with IWP and BPJS

-

Integration with SIMDA FMIS

-

Payment of JKK and JKM

-

Budget dashboard and its realization

-

Mobile Apps Dashboard for realtime reporting to stakeholders.

Ingin tahu bagaimana ESPAY memberikan solusi untuk Anda?